Why Would You Need a Home Insurance Binder? That same unfortunate accident happens-but this time you can prove that you're fully and legally covered by your insurance company. You printed it and you have a copy in the car with you. Nooooo!īest-case scenario? You already have an insurance binder. Guess what? You're responsible for damages, and your finances take a big hit.

Worst-case scenario? Your actual policy hasn't been issued yet, you didn't get a binder, and you get in a car accident in that dream car. Here are some examples to give you a picture of what this could look like: But if for any reason there’s a delay in the underwriting process, an insurance binder ensures that you’re protected from the moment you purchase the policy for your dream car to the moment the underwriting process is complete.Įssentially, binders make sure you're not financially liable for any unfortunate accidents. Thanks to the internet’s lightning-fast speed, insurance companies can usually prepare and digitally send your formal policy within minutes. Think back to that dream car scenario we talked about earlier. Why Would You Need a Car Insurance Binder? Your insurance company might automatically issue a binder, but you should always ask. You want to be sure you're covered while the policy is being written. However, if you're buying a new policy and the underwriting process is going to take time, definitely ask for a binder. If your policy is issued immediately, you don't need a binder. Should I Ask for a Binder When I Buy an Insurance Policy? It’s a short list, but each type of binder does come with its own potential scenarios and requirements that you’ll need to keep in mind. Now this is the easy part-there are only two types of insurance binders.

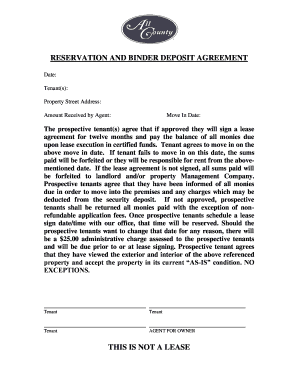

You're legally protected by an insurance contract exactly as if the official policy has already been approved by underwriting. More importantly though, it's called a binder because it's legally binding.

The same terms that are specified in your policy are also legally enforceable as part of an insurance binder.īut why is it called a binder? Isn't it more like a safety net? A bridge? A connection? Well. It's a temporary legal placeholder until your official insurance policy is issued. We’ll break it down.Īn insurance binder basically proves that there’s a formal agreement in place between you and the insurance company. You can drive it, but you need a car insurance binder. Does that mean you can't drive your dream car for a whole week because you don't have any insurance? Not necessarily. You've already called your insurance agent with the car's details and the type of coverage you want, but it's going to take a week for the underwriter to complete the formal contract. After saving for years and browsing for months, you finally found The One-it’s even the right color!

0 kommentar(er)

0 kommentar(er)